2 cryptocurrencies to reach 100 billion market cap by year-end

![]() Cryptocurrency Nov 1, 2024 Share

Cryptocurrency Nov 1, 2024 Share

The crypto market faced a surge of selling pressure this week, unsettling investors as Bitcoin (BTC) dropped by 4% before rebounding to $71,000.

Despite the recovery, caution remains, as many investors await clearer signals before making decisive moves.

Amid this market movement, several altcoins are inching closer to significant milestones, with the $100 billion market cap threshold in sight.

Picks for you

Here’s what awaits gold after the U.S. presidential elections 6 hours ago Ripple v. SEC case update: November 1, 2024 6 hours ago Analyst reveals when to catch the next buying opportunity for Bitcoin 6 hours ago Nvidia stock could crash if major client is delisted 8 hours ago

Finbold has highlighted two promising assets, BNB Chain (BNB) and Solana (SOL), both of which are on a strong trajectory to reach this milestone by year-end, supported by robust fundamentals and growing market momentum.

Solana (SOL)

Solana, currently trading at $166.44, is well-positioned to potentially reach a $100 billion market cap by the end of 2024, supported by strong institutional interest, increased network activity, and robust derivatives data.

In Q3 2024, institutional investments in Solana-based DApps surged, with $173 million raised, the highest level in over a year, signaling growing confidence in its ecosystem.

Soana market cap. Source: CoinMarketCap

Soana market cap. Source: CoinMarketCap

This influx of capital is expected to fuel adoption and development within Solana, strengthening its market position.

The recent memecoin frenzy, highlighted by tokens like Goatseus Maximus (GOAT), has further driven user engagement, pushing network revenue from transaction fees to $4 million daily and setting a record with over 8 million active addresses on the network.

Solana has also surpassed BNB Chain to become the second-largest network in terms of liquid total value locked (TVL), though it still trails Ethereum (ETH).

The gap has been narrowing in recent years, with developments like Binance’s SOL liquid staking service, now among the top services in the Solana ecosystem, indicating additional growth potential.

In decentralized exchange (DEX) volumes, Solana has recently outpaced Ethereum, underscoring its growing influence in the market.

With these strong fundamentals, Solana’s current rally appears sustainable, setting it on a promising path to achieving a $100 billion market cap by year-end.

BNB Chain (BNB)

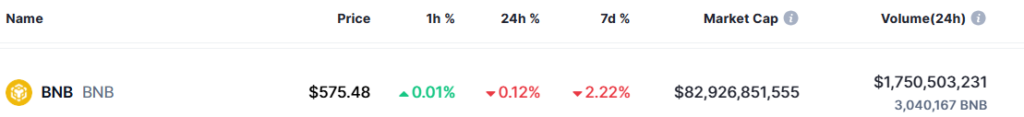

BNB, currently priced at $575.65 with a market cap of $82.95 billion, shows strong potential to reach a $100 billion market cap by year-end.

Recent fundamentals support this outlook, particularly with BNB’s robust performance in decentralized exchange (DEX) trading, where it ranks third among top networks by volume over the past 30 days.

BNB market cap. Source: CoinMarketCap

BNB market cap. Source: CoinMarketCap

This sustained activity highlights BNB’s appeal among traders and its importance within the decentralized finance (DeFi) sector.

Increased DEX volumes enhance BNB’s utility and demand as users engage in DeFi and trading activities.

Furthermore, BNB Chain’s regular token burn events continue to apply deflationary pressure on BNB’s supply. In its recent 29th quarterly burn, the network eliminated over 1.77 million BNB, valued at approximately $1.07 billion.

This ongoing reduction in supply, coupled with increasing utility and demand, creates favorable conditions for price appreciation.

Additionally, Binance Co-founder CZ’s positive remarks about the future of the crypto market have bolstered market sentiment, helping BNB hold above the critical $570 support level.

With growing market confidence, both Solana and BNB are on track to achieve significant milestones, including the potential to reach $100 billion market caps in the coming weeks.

Investors should keep a close eye on these assets as they leverage their strong DeFi presence and increasing utility to navigate through volatility and unlock potential gains ahead.