Bitcoin crashes again—what’s behind the $985 million crypto market wipeout in a day?

![]() Cryptocurrency Mar 4, 2025 Share

Cryptocurrency Mar 4, 2025 Share

The cryptocurrency market has suffered another sharp downturn, with Bitcoin (BTC) plunging more than 10% in the past 24 hours, now trading below $85,000.

The crash triggered over $985 million in liquidations, wiping out earlier gains fueled by Trump’s weekend proposal for a US strategic crypto reserve. The sell-off erased $460 billion from the total crypto market capitalization, leaving investors unsettled as panic sets in.

Crypto market crash sees surge in liquidations

The market-wide collapse led to a significant spike in liquidations, with Bitcoin alone accounting for $370 million in wiped-out positions in the last 24 hours. Ethereum (ETH) saw $190 million in liquidations, followed by Solana (SOL) with $58.87 million, XRP with $51 million, and Cardano (ADA) with $36 million.

Picks for you

EU defense spending surges 122% in a decade – report 2 hours ago Sell alert: XRP price facing sharp correction to $1 3 hours ago Crypto market wipes out $120 million in an hour 20 hours ago 2 cryptocurrencies to reach a $10 billion market cap in March 21 hours ago  Crypto market liquidation. Source: CoinGlass

Crypto market liquidation. Source: CoinGlass

The timing of the crash coincided with President Trump’s new tariffs on Mexico and Canada, which took effect on March 4.

A day earlier, Bitcoin had surged nearly 20% from its November lows following Trump’s announcement of a US strategic crypto reserve. However, concerns over regulatory hurdles and political feasibility dampened enthusiasm, leading to a swift pullback.

Notably, Bitcoin critic Peter Schiff called the announcement the “biggest crypto rug pull of all time.” Schiff even demanded a Congressional probe into whether Trump’s inner circle might have profited from the initial market surge before the collapse.

Donald Trump, the first crypto President, just helped pull off the biggest crypto rug pull of all time. A Congressional investigation is now warranted to find out the following regarding this pump and dump scheme.

Who authored the two Sunday afternoon posts on the President's…

— Peter Schiff (@PeterSchiff) March 3, 2025

Bitcoin’s February sell-off marks one of the worst in history

Bitcoin wrapped up February with a 17.39% monthly drop, marking its second-worst February on record, only surpassed by a 31.03% crash in 2014.

Bitcoin Monthly returns(%). Source: CoinGlass

Bitcoin Monthly returns(%). Source: CoinGlass

Historically, February has been a strong month for Bitcoin, with an average gain of 13.12% over the past decade. The last time Bitcoin experienced a similar February decline was in 2014, when it lost over 31% following the Mt. Gox exchange collapse, one of the biggest crises in Bitcoin’s history.

The sharp selloff was compounded by Bitcoin ETF outflows, which peaked at $1.1 billion on February 25, according to Farside data indicating weakening institutional demand.

What’s next for Bitcoin?

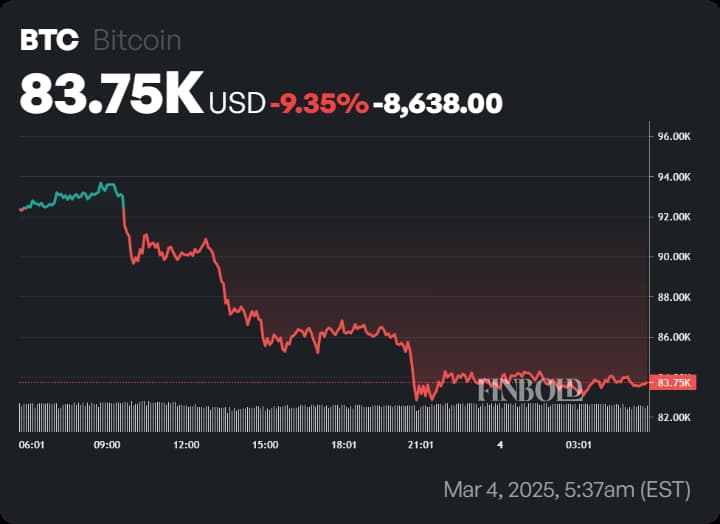

At press time, Bitcoin is trading at $83,724, down 10% in the past 24 hours and 22% below its January peak of $108,066. Despite the sharp decline, some prominent industry figures remain optimistic about the cryptocurrency’s long-term outlook.

Bitcoin one-day price chart. Source: Finbold

Bitcoin one-day price chart. Source: Finbold

Former BitMEX CEO Arthur Hayes believes that Bitcoin’s worst-case scenario would see a floor near $70,000, in line with previous cycle peaks.

Similarly, CryptoQuant CEO Ki Young Ju suggested that even if BTC drops to $77,000, it would still be a healthy retracement within a broader bullish phase rather than a shift into a bear market.

That being said, for now, the crypto market is experiencing one of its most volatile phases of 2025, with regulatory clarity and macroeconomic stability emerging as key factors for recovery.

Featured image via Shutterstock