Bitcoin has experienced significant difficulty in surpassing the $85,000 mark this week, and its price remains stagnant below this key resistance.

Bitcoin enthusiasts are increasingly frustrated as the cryptocurrency struggles to maintain upward momentum. Along with this price stagnation, there has been a noticeable decline in open interest and ETF outflows, which reflect growing uncertainty in the market.

Bitcoin Spot ETF Flows Are Concerning

Spot Bitcoin ETFs have been experiencing heavy outflows recently, with $171.1 million in outflows recorded on Wednesday, April 16 alone, marking the highest for this week. This shift signals waning investor confidence in Bitcoin as market conditions remain bearish. As more investors pull their funds, it highlights a diminishing trust in Bitcoin’s short-term prospects.

Bitcoin Spot ETF Flows. Source: Farside

Bitcoin Spot ETF Flows. Source: Farside

The ongoing outflows suggest that the broader market sentiment is souring towards Bitcoin. The heavy movement of funds away from Bitcoin ETFs shows that investors are growing cautious, driven by the failure of Bitcoin to gain a foothold above $85,000. This lack of growth in price has led to uncertainty and hesitation among traders.

Open Interest Needs A Push

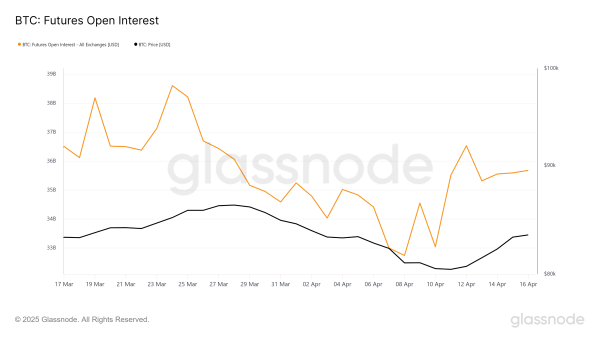

The open interest in Bitcoin remains under $36 billion, a sign that traders are skeptical about Bitcoin’s immediate future. Despite some early optimism earlier in the year, the lack of any recovery or significant price movement has kept the open interest stagnant.

Bitcoin Open Interest. Source: Glassnode

Bitcoin Open Interest. Source: Glassnode

This flatness in open interest indicates that Bitcoin is facing a period of indecision in the market. Traders seem hesitant to make aggressive bets on either direction, given the stagnant price and broader market conditions. Without an increase in open interest, Bitcoin may struggle to break out of its current range.

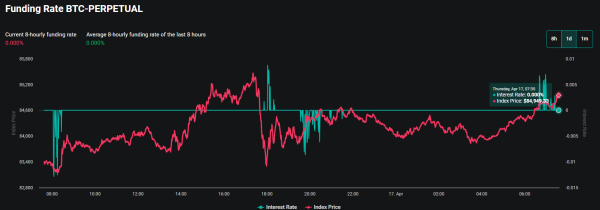

Funding Rate Recovers

Despite the skepticism, Bitcoin’s funding rate has seen a recent shift. After being negative for some time, it has turned positive in the past few hours, reflecting a slight uptick in market optimism.

Bitcoin Funding Rate. Source: Deribit

Bitcoin Funding Rate. Source: Deribit

While the positive funding rate indicates renewed optimism, it is still early to determine whether this sentiment will result in sustained upward price action. A sustained positive funding rate could suggest that Bitcoin might see a more significant rebound if the broader market conditions improve.

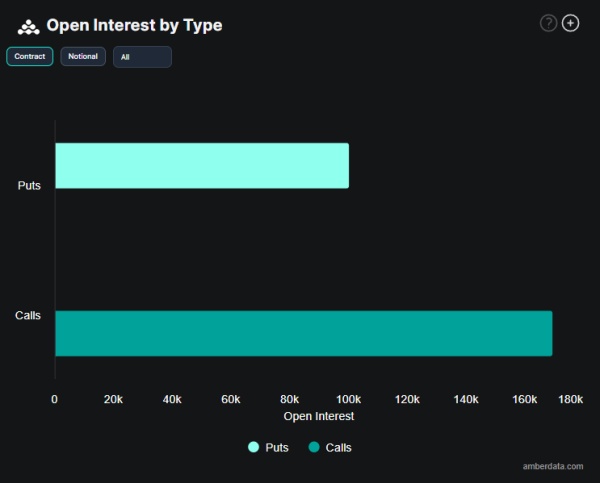

Calls Vs. Puts

Open interest data further backs this optimistic shift, as call options now dominate the market, with over 169,760 call contracts placed.

BTC Options Open Interest by Type. Source: Deribit

BTC Options Open Interest by Type. Source: Deribit

The predominance of calls over puts suggests that market participants are expecting a bullish move. This is despite the recent lack of progress in Bitcoin’s price. Whether this optimism will be realized depends on broader market trends and Bitcoin’s ability to surpass the $85,000 barrier.