Bitcoin long/short ratio hits 1-month high

![]() Cryptocurrency Apr 22, 2025 Share

Cryptocurrency Apr 22, 2025 Share

Despite a significant move to the upside in recent days, futures traders are betting that the current Bitcoin (BTC) rally will continue.

Namely, Bitcoin’s long/short ratio has reached a 1-month high of 1.0559, indicating that 51.36% of derivatives positions opened in the last 24 hours have been bullish, per data retrieved by Finbold from cryptocurrency futures trading and information platform CoinGlass on April 22.

Bitcoin long/short ratio chart. Source: CoinGlass

Bitcoin long/short ratio chart. Source: CoinGlass

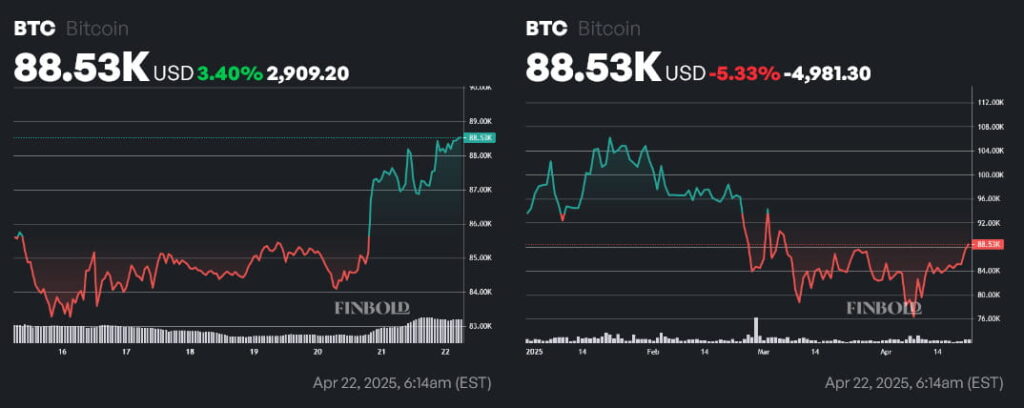

In the closing hours of Sunday, April 20, Bitcoin (BTC) shot up from $85,000 to $87,000. By press time on April 22, the leading cryptocurrency was changing hands at a price of $88,530, having marked a 3.40% gain on the weekly chart that has brought year-to-date (YTD) losses down to 5.33%.

BTC price 1-week and year-to-date (YTD) charts. Source: Finbold

BTC price 1-week and year-to-date (YTD) charts. Source: Finbold

Is the Bitcoin long/short ratio a reliable signal?

The second Bitcoin long/short ratio in the past 30 days, at 1.05, which is equivalent to 51.23% of positions being long, was seen on April 12. At the time, the flagship digital asset was trading at $82,944 — so a move to the upside did indeed ensue, as BTC price is currently trading 6.73% higher.

However, traders should always be wary of undue optimism. The metric is useful, as it provides clear insight into the sentiment of futures traders — but at the end of the day, this is only one piece of the puzzle.

Some, like Fundstrat’s Tom Lee, are blaming Bitcoin’s troubles earlier this year on overleveraged institutional positions — and think that the cryptocurrency could even match gold’s meteoric rise going forward. On the other hand, HS Dent Investment Management founder Harry Dent believes that BTC will spearhead the crash of the ‘everything bubble’ later this year.

It’s clear that market-wide dynamics and macro concerns will be the main factor impacting BTC’s price action going forward — however, the leading digital asset is beginning to show signs of resilience, at least in the near term.

Featured image via Shutterstock