Cryptocurrency analysis firm Alphractal has shared a new analysis claiming that Bitcoin has reached a critical level in terms of market dynamics.

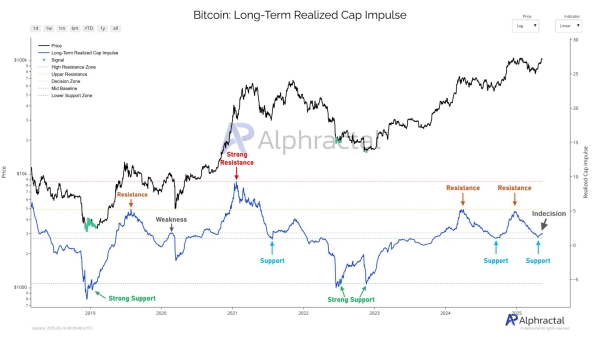

Long-Term Realized Market Value Momentum, the long-term on-chain data metric used by the company, provides important insights to investors by measuring the supply-demand balance directly on the blockchain.

According to the analysis, Bitcoin is currently trading in an uncertainty zone defined by strong support and resistance zones, both technically and historically. A breakout above this level could signal continued strong demand in the market and pave the way for a renewed rally.

However, Alphractal also reminds investors to be careful, as the same region was tested and rejected before the “Coronavirus Dump” in March 2020, triggering a massive market sell-off.

Long-Term Realized Market Value Momentum metric.

Long-Term Realized Market Value Momentum metric.

Commenting on the issue, Alphractal CEO Joao Wedson said:

“The best strategy for now is to watch what happens in Bitcoin, as the $105,000–$106,000 range represents a medium-risk area. The Long-Term Realized Market Cap Momentum metric should be monitored daily, as it provides a direct on-chain view of the supply and demand dynamics behind price movements.”

The company warns investors in its analysis:

“In the short term, it is wise to be cautious. Risk increases in such sensitive areas. We will re-evaluate this post in the future to see how Bitcoin responds.”

*This is not investment advice.