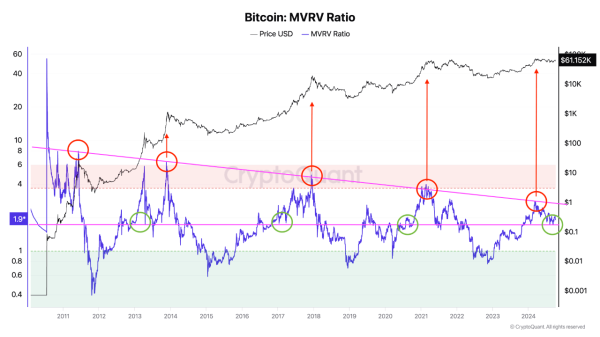

A CryptoQuant analyst using the pseudonym “tugbachain” has recently shed light on a key trend within the Bitcoin market. Posting on the CryptoQuant QuickTake platform, the analyst focused on the Market Value to Realized Value (MVRV) ratio, an important metric in the Bitcoin market.

According to tugbachain, the MVRV ratio shows a historical downward trend. Should this trend continue or get breached, it may lead to a major impact on Bitcoin.

MVRV Ratio And Its Impending Impact On Bitcoin

The MVRV ratio, as explained by tugbachain, is a tool used to gauge whether a cryptocurrency is overvalued or undervalued. This ratio is calculated by comparing the market value to the realized value of Bitcoin, providing insights into investor behavior and market trends.

The analyst highlighted that the MVRV has proven useful in identifying market tops, bottoms, and notable peaks and troughs over the years. The MVRV ratio has historically demonstrated three major Bitcoin halving cycles, each marked by unique price behavior and investor sentiment.

The current ratio sits around 1.9, with significant support noted at 1.75. The question raised by tugbachain is whether breaking the downtrend could lead to a rise in the MVRV ratio to the 4-6 range, which has historically signaled a Bitcoin peak.

The analyst wrote in the post:

Currently, the MVRV ratio shows a historical downtrend with significant support at 1.75. With the ratio now sitting at 1.9, the question arises: if it breaks the downtrend and reverses the downtrend, could it once again climb to the 4-6 range, marking a Bitcoin peak as seen in previous cycles?

BTC Market Performance And Technical Outlook

Bitcoin has seen heightened price activity in recent weeks in the broader market context. The asset rallied above $66,000 last week, sparking enthusiasm in the crypto community with hopes for a bullish October, playfully termed “Uptober.”

However, this upward momentum was short-lived, as BTC experienced a notable price correction soon after. Within the past week alone, Bitcoin has seen a decline of around 7.2%, falling to a trading price of $61,496 at the time of writing.

Despite this correction, BTC has rebounded slightly, posting a modest 1.9% gain over the past 24 hours. Aside from tugbachain’s analysis, other crypto market analysts have provided additional perspectives on the MVRV ratio’s implications for BTC.

Ali, a prominent analyst on the social media platform X, has pointed out that the MVRV ratio’s behavior since May has notably impacted Bitcoin’s price movements.

Ali observed that each rejection of the MVRV ratio from its 90-day average has historically led to a significant correction in Bitcoin’s price. According to Ali, the latest rejection has already resulted in a 10% drop, suggesting the possibility of further downside pressure.

Featured image created with DALL-E, Chart From TradingView