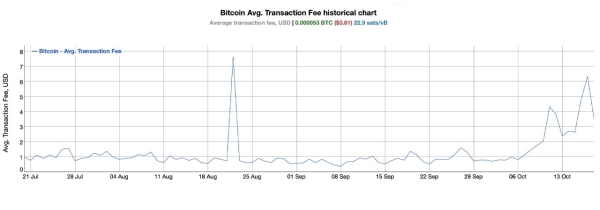

While bitcoin’s price has remained above $68,000, onchain fees tagged along for the ride. Earlier this month, fees were below $1, but two days ago on Oct. 17, the average transfer fee hit a peak of $6.32. Today, onchain fees stand at around 22.9 satoshis per virtual byte (sat/vB), or roughly $3.61 per transaction.

Bitcoin’s $68K Price Push Sparks Fee Increases

The latest spike in onchain fees correlates with bitcoin’s rise past $68K. For instance, on Oct. 6, the average transfer fee, according to bitinfocharts.com data, was just $0.81. Fast forward to now, and that fee has jumped over 354%, landing at $3.61. On Oct. 17, it spiked even more dramatically, reaching 680% higher than the Oct. 6 rate.

Average BTC fee on Oct. 19, 2024, according to bitinfocharts.com data.

Average BTC fee on Oct. 19, 2024, according to bitinfocharts.com data.

However, averages don’t tell the full story for everyone. A more typical median fee is around 0.000017 BTC or 7.4 sat/vB, translating to $1.16 at current rates. High-priority transactions, according to mempool.space, show even lower costs, around 4 sat/vB or $0.38 per transaction at 3 p.m. Eastern Time on Saturday. Yet, Bitcoin’s mempool still holds a queue of 213,015 unconfirmed transfers.

Moreover, October’s fee totals have already outdone last month’s figures. Bitcoin miners pulled in $13.86 million from onchain fees in September. So far in October, with nearly two weeks left, miners have amassed $27.54 million in fees alone. Last month’s combined revenue from fees and the subsidy hit $815.7 million, while October’s revenue has reached $568.95 million so far—equivalent to about 69.74% of September’s total haul.

As bitcoin’s price momentum continues to ripple through transaction costs and mining revenue, the network’s evolving fee dynamics point out the complexities of market behavior. While the recent increases impact user decisions, they also reinforce bitcoin’s role in balancing supply, demand, and miner incentives. Looking forward, sustained price shifts could further reshape the interplay between fees and network capacity.

What are your thoughts on this subject? Let us know what you think in the comments section below.