Savvy crypto trader turns $318k into over $3 million in an hour

![]() Cryptocurrency Nov 11, 2024 Share

Cryptocurrency Nov 11, 2024 Share

A savvy cryptocurrency investor has recorded a ten-fold return on an investment of approximately $318,000 through precise market monitoring.

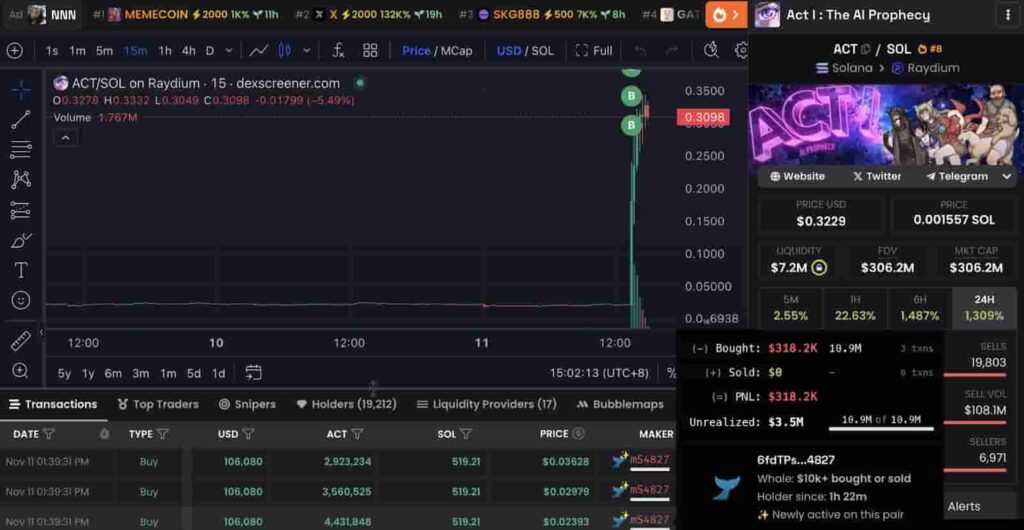

The transaction involved Solana (SOL) and the artificial intelligence-themed Act I: The AI Prophecy (ACT) in a trade conducted on Raydium, a decentralized exchange (DEX) built on the Solana blockchain.

Details of the trade indicate that the investor invested 1,558 SOL ($318,000) to acquire 10.9 million ACT tokens, according to the latest data retrieved by Finbold from on-chain crypto analysis platform Lookonchain on November 11.

Picks for you

El Salvador is now in $200 million profit on their Bitcoin bet 14 hours ago AI predicts Cardano price for 2025 amid Hoskinson-Trump rumors 17 hours ago We asked this AI to build a crypto portfolio for the altseason bull market 17 hours ago How much would $1,000 in Bitcoin from the 2020 COVID-19 crash be worth today 18 hours ago  ACT/SOL trading pair on Raydium. Source: Dex Screener

ACT/SOL trading pair on Raydium. Source: Dex Screener

The trader’s initial investment soared to $3.4 million in under 60 minutes as ACT skyrocketed following its listing on Binance.

Drivers of ACT popularity

ACT is one of the meme coins that has gained popularity since its launch on the Solana blockchain, fueled by growing community enthusiasm and the general bullish market sentiment.

The token’s spike was ignited after Binance announced its listing on November 11 under the ACT/USDT pair, with withdrawals set for November 12. The announcement also included another popular meme coin, Peanut the Squirrel (PNUT).

Notably, ACT is part of the latest wave of meme coins listed by Binance in 2024. Despite an initially low market cap, it earned a place on the exchange as it appears to be listing these coins based on community enthusiasm.

This approach has raised concerns that Binance might be evolving into a ‘pump and dump’ platform, with accusations of intentionally harming retail investors and creating an unhealthy meme coin environment.

These listings have so many issues:

– Insiders front ran the public announcement making $100M+

– Both were low cap, poorly distributed tokens prior to the listings

– Binance provided zero transparency into the listing fee that was paid and when they will dump it— Leonidas (@LeonidasNFT) November 11, 2024

Interestingly, Binance is listing the tokens despite the trading platform’s report indicating that 97% of meme coins are dead.

ACT price analysis

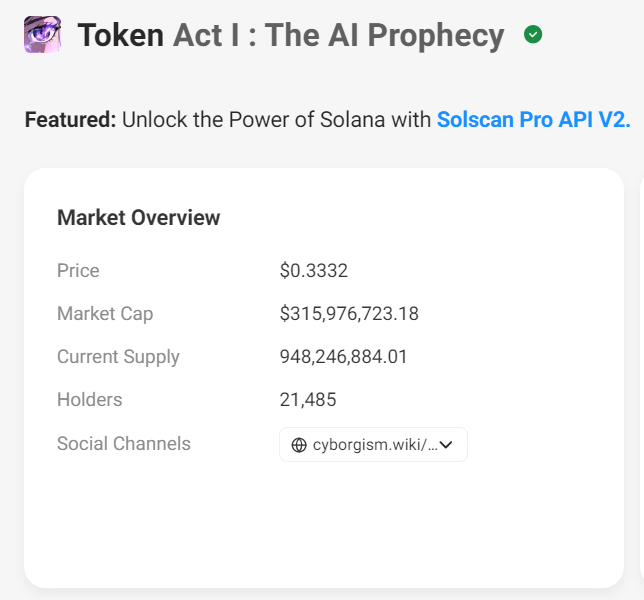

ACT was valued at $0.333 as of press time, marking a staggering 1,400% increase in the past 24 hours.

The short-term buying pressure has resulted in the meme coin recording a market cap of $315 million, peaking at almost $350 million at one point, with over 21,000 holders.

ACT oncgain metrics. Source: Solscan

ACT oncgain metrics. Source: Solscan

It’s worth noting that ACT is among a growing number of meme coins inspired by AI. In this case, ACT involves spontaneous interactions without scripts, multi-agent dynamics, continuous and long-term observations, diverse AI participants, and real-world environments.

Insider trading concerns

The ten-fold return by the ACT investor is adding to the growing trend of traders raking in millions of dollars from modest investments. This trend has raised questions about whether these traders are simply lucky or possibly acting on insider information.

For example, in October, Finbold reported that one trader turned $368 into $2 million in three days. Concerns were further amplified after another trader achieved significant returns from suspicious trading patterns of AI-themed Goatseus Maximus (GOAT) and Daddy Tate (DADDY), a token linked to internet personality Andrew Tate.

Featured image via Shutterstock