Rumble stock price prediction as CEO follows MicroStrategy’s Bitcoin steps

![]() Stocks Nov 20, 2024 Share

Stocks Nov 20, 2024 Share

Rumble Inc (NASDAQ: RUM) CEO Chris Pavlovski publicly considered adding Bitcoin (BTC) to the company’s balance sheet on November 19. MicroStrategy Inc (NASDAQ: MSTR) Founder and Chairman Michael Saylor offered support, quickly making Rumble stock surge before the market’s closing.

https://twitter.com/saylor/status/1858945523258159169

Looking ahead, Finbold turned to artificial intelligence (AI) models and asked for a price prediction to RUM for 2025 year-end.

Notably, since MicroStrategy acquired Bitcoin for the first time on August 11, 2020, BTC is up 732% by press time. Meanwhile, MSTR stock surged by 2,938% in the same period, going from $14.44 to $438.76 per share.

Picks for you

Bitcoin path to $200,000: Technical indicators signal aggressive rally ahead 40 mins ago ‘Rich Dad’ R. Kiyosaki makes super bullish Bitcoin prediction 3 hours ago Cardano’s key price levels to watch as ADA is on the cusp of a breakout 18 hours ago Sell signal for 2 overbought cryptocurrencies this week 19 hours ago

As of this writing, MicroStrategy is one of the world’s largest Bitcoin holders, with 331,200 BTC in treasury. This means the company holds 1.57% of Bitcoin’s supply and raises questions on whether Rumble will follow its steps.

MicroStrategy BTC holdings over time (left) & MSTR stock all-time chart (right). Source: Bitcoin Treasuries / Finbold

MicroStrategy BTC holdings over time (left) & MSTR stock all-time chart (right). Source: Bitcoin Treasuries / Finbold

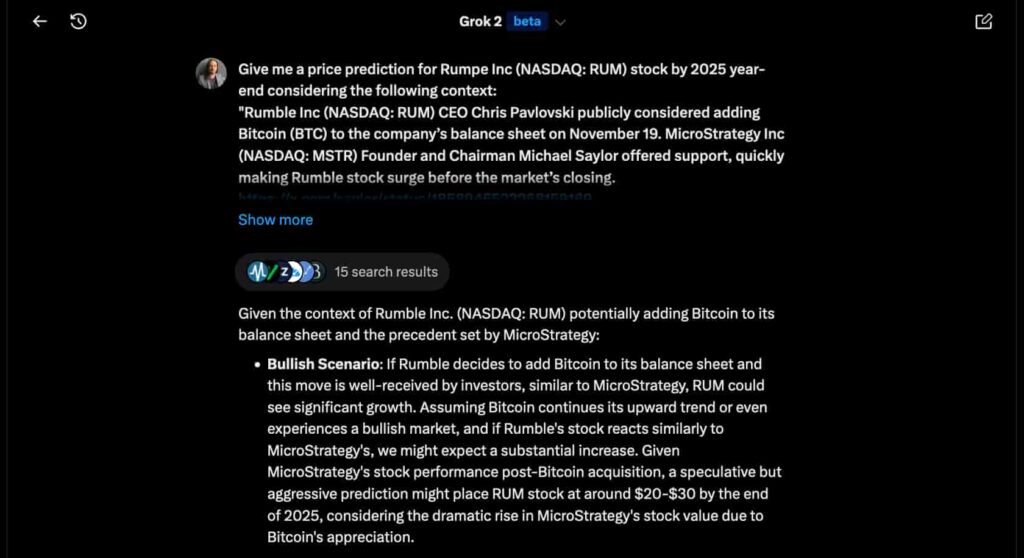

Grok AI Rumble stock price prediction for 2025 year-end, following MicroStrategy’s Bitcoin steps

In this context, Finbold asked xAI’s Grok 2 for a Rumble stock price prediction, resulting in three scenarios. The prediction considers the RUM price close on Tuesday, November 19, of $5.86 per share.

Rumble jumped 8.5% from Tuesday’s opening and over 4% after Chris Pavlovski’s post on X.

Rumble Inc. (NASDAQ: RUM) five-day stock price chart. Source: Finbold

Rumble Inc. (NASDAQ: RUM) five-day stock price chart. Source: Finbold

Grok AI’s bullish scenario for Rumble stock price amid potential Bitcoin adoption

First, Grok’s AI believes RUM could go as high as $20 to $30 per share by the end of 2025. For this scenario to play out, Bitcoin must continue its rise in price while Rumble picks up momentum.

Overall, the Youtuber competitor would follow MicroStrategy’s historical pattern while the company gradually started accumulating Bitcoin.

Rumble bullish stock price prediction following MicroStrategy’s Bitcoin steps. Source: Grok 2 / Finbold / @vinibarbosabr

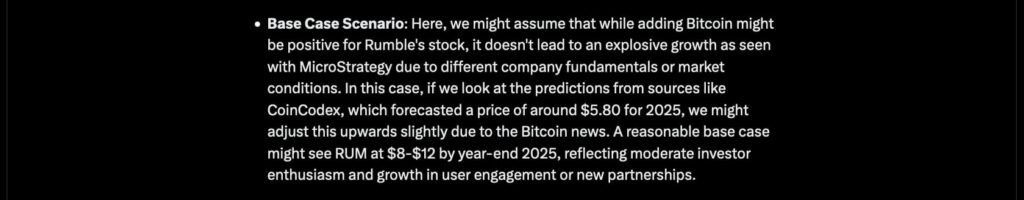

The base-case scenario for RUM

However, things may not go exactly as with MicroStrategy. This leads to a conservative, although optimistic, base-case scenario for Rumble amid a potential adoption of the Bitcoin treasury strategy.

In Grok’s eyes, RUM could see a range between $8 and $12 per share by year-end 2025. The prediction slightly adjusts a CoinCodex forecast of $5.80 per share for 2025.

Rumble base-case stock price prediction following MicroStrategy’s Bitcoin steps. Source: Grok 2 / Finbold / @vinibarbosabr

Rumble base-case stock price prediction following MicroStrategy’s Bitcoin steps. Source: Grok 2 / Finbold / @vinibarbosabr

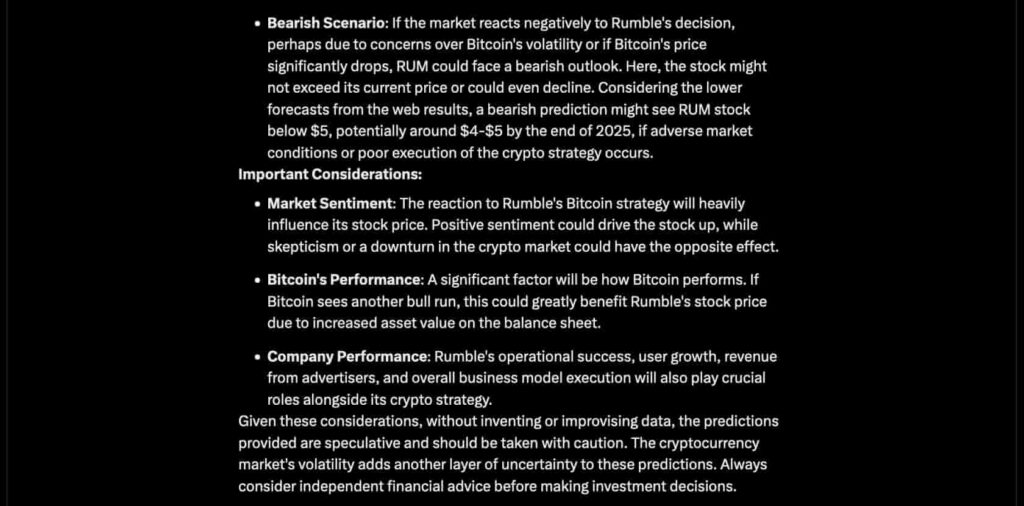

The bearish price prediction

On the other hand, Bitcoin could still fail to meet the market’s expectations of a bull run in 2025. If this or other negative factors come into play for Rumble, the stock could trade below its current price.

The bearish scenario predicts RUM to trade around $4 and $5 in this case, but the AI warns of uncertainty.

Rumble bearish stock price prediction following MicroStrategy’s Bitcoin steps. Source: Grok 2 / Finbold / @vinibarbosabr

Rumble bearish stock price prediction following MicroStrategy’s Bitcoin steps. Source: Grok 2 / Finbold / @vinibarbosabr

Interestingly, prominent analysts like CryptoQuant CEO Ki Young Ju have pointed toward a growing euphoria regarding Bitcoin’s current price appreciation. Historically, this marks a “euphoric phase,” which lasts from three to twelve months before entering a bear market.

Thus, Rumble could be considering buying BTC close to its top, risking holding a losing position for a few years. This scenario played out for MicroStrategy after the company’s largest Bitcoin purchases during the most euphoric phase of the market.

Featured image from Shutterstock.