Crypto market sees $80 billion inflows in a day

![]() Cryptocurrency Apr 1, 2025 Share

Cryptocurrency Apr 1, 2025 Share

On March 27, the crypto market saw its total market capitalization fall by $100 billion in the span of just 24 hours. This was followed by further losses, as digital assets marked $100 billion in outflows over the course of the weekend.

Around noon on Sunday, March 31, a local bottom was reached, with the total crypto market cap falling to levels as low as $2.63 trillion. However, on April 1, the wider market staged a comeback, and the total valuation soared by $80 billion to reach $2.71 trillion as of press time.

Total cryptocurrency market cap 30-day chart. Source: CoinMarketCap

Total cryptocurrency market cap 30-day chart. Source: CoinMarketCap

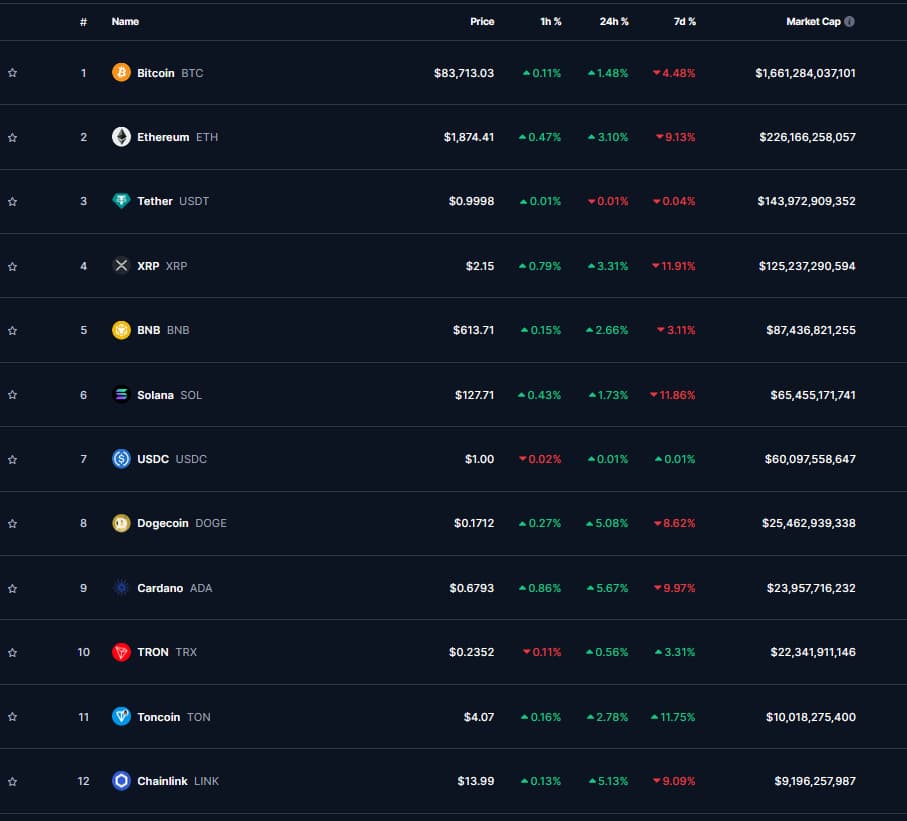

What’s more, the market cap increase was not the result of a localized upswing, or, in other words, a surge in a large-cap asset’s price. On the contrary, the move to the upside has been pretty universal — at present, all of the top 10 cryptocurrencies by market cap are in the green on a 24-hour chart, with the exception of stablecoins like USD Coin (USDC) or Tether (USDT), which have seen negligible price moves.

Picks for you

ChatGPT builds ideal crypto portfolio for Q2 2025 2 hours ago Crypto trader loses $3.7M after Binance's sudden rule update 3 hours ago Mosaic Alpha launches the Basket Manager Combine contest 4 hours ago Robert Kiyosaki’s Q1, 2025 portfolio performance 4 hours ago  Top 10 cryptocurrencies by market cap with 1h, 24h, and 7d price movement. Source: CoinMarketCap

Top 10 cryptocurrencies by market cap with 1h, 24h, and 7d price movement. Source: CoinMarketCap

The biggest gainer in the top 100 in the past 24-hours has been the Curve DAO Token (CRV), which has rallied by 11.94% over the past day.

CRV 1-day price chart. Source: CoinMarketCap

CRV 1-day price chart. Source: CoinMarketCap

As bullish as this latest development appears to be, there’s still an open question as to whether or not the rally, or rather recovery, will continue. Let’s take a closer look at the most impactful macro factors currently at play — tariffs.

Crypto market still at risk from looming trade war

The Trump administration’s ‘trigger-friendly’ approach to imposing tariffs is the key driver behind recent market instability. While the imposition of tariffs and duties doesn’t directly impact cryptocurrencies, it does raise the risk of recession, reduces the odds of interest rate cuts, and tends to make investors run away from risky assets in favor of safe havens such as gold or even fixed-income assets.

On April 2, the President will unveil the latest round of tariffs. Trump has previously stated that ‘all countries’ would be targeted, although a definitive blueprint isn’t in place yet. One solution that is being considered is a blanket 20% tariff that would impact most of the goods imported by the United States, per a Washington Post report. A proposal that would put that solution into effect has reportedly already been drafted by White House aides.

Despite the increase in inflows, market sentiment hasn’t shifted significantly — so investors would do best to exercise caution and patience, and wait for the smoke to clear before deciding on what to do.

Featured image via Shutterstock