Forget Bitcoin; This miner is outperforming BTC sixfold

![]() Stocks Mar 24, 2025 Share

Stocks Mar 24, 2025 Share

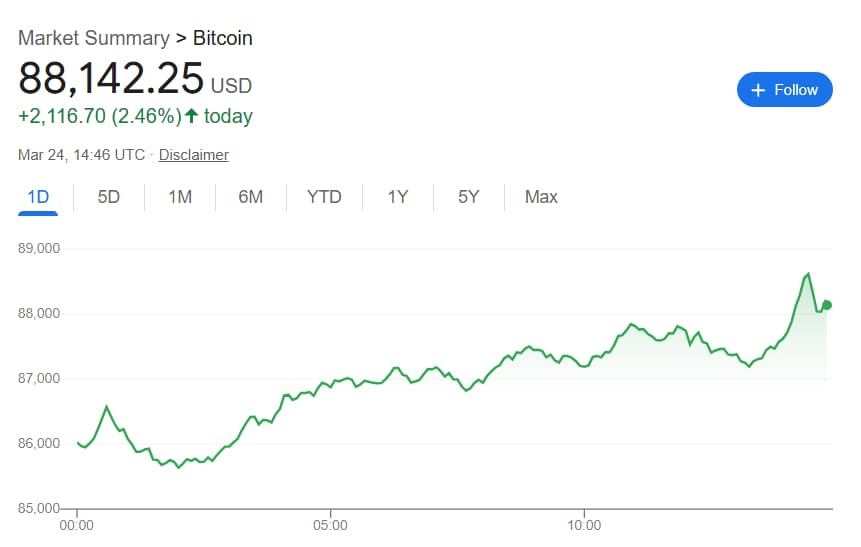

On March 24, Bitcoin (BTC) is spearheading what appears to be a cryptocurrency market resurgence after weeks of turbulence and stagnation. Specifically, on Monday, BTC soared 2.46% to its press time price of $88.142.

BTC 1-day price chart. Source: Google

BTC 1-day price chart. Source: Google

The rally was the extension of a greater rise that started on Sunday, March 23, and kicked off with the world’s premier cryptocurrency changing hands at about $84,000.

For the excitement in the digital assets market, its primary stock market extension, a selection of blockchain companies have been making even grander moves.

Picks for you

2 cryptocurrencies to reach a $100 billion market cap in April 1 hour ago Recession fears loom as the 'Dow Jones to Gold Ratio' could cross rare historical level 4 hours ago If you invested $1,000 in XRP at the start of 2025; Here’s how much you’d have now 7 hours ago XRP adds $100 billion to its market cap in a year 7 hours ago

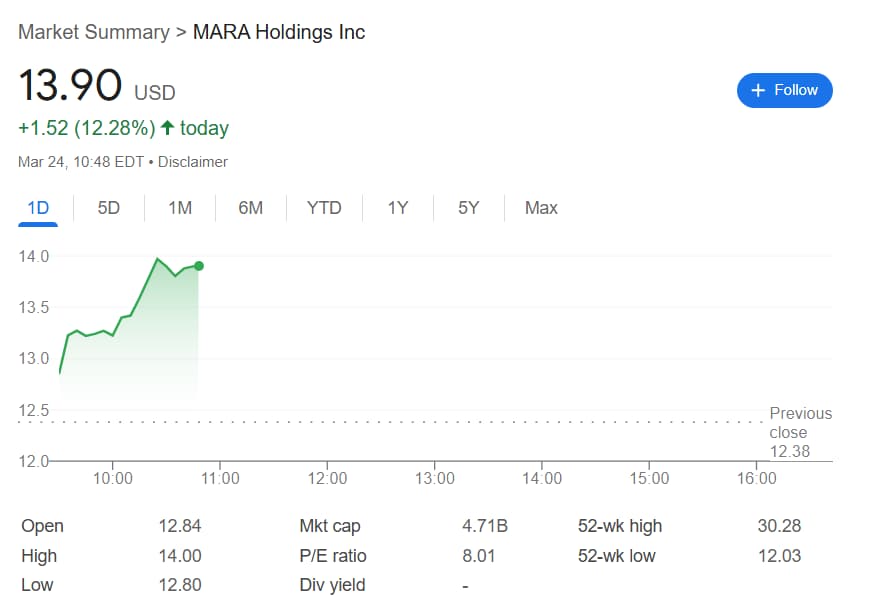

Of these, MARA Holdings Inc. (NASDAQ: MARA) proved among the best-performing stocks in the initial hours after the morning bell rang. By press time on March 24, MARA shares had rallied 12.28% in the Monday session – almost six times as much as BTC – and are changing hands at $13.90.

MARA stock 1-day price chart. Source: Google

MARA stock 1-day price chart. Source: Google

Why MARA stock is soaring today

Examining the recent developments regarding the miner, it appears that the chief – possibly sole – driver of the upswing is the cryptocurrency market rise in the last 24 hours.

The strength of the tailwind is also observable in the other stock most linked with Bitcoin, Strategy (NASDAQ: MSTR) as it is up 6.93% to $325.08 in the March 24 session.

Still, MARA shares’ leadership in Monday’s trading is also likely a result of a mix of other long-standing factors. To begin with, concerns over several protracted periods of BTC price stagnation – especially in the aftermath of the April 2024 halving – have pummeled miners’ equity.

MARA Holdings stock is itself 33.39% down in the last 12 months and 18.91% in the red since 2025 started.

Such a price situation, paired with relatively consistently strong earnings – the miner beat Wall Street forecasts in three out of the last four reports – created a situation in which MARA equity appears decidedly undervalued and ready to take advantage of the Bitcoin rally.

Featured image via Shutterstock