The price of bitcoin dipped to $58,867 on Thursday, around 2 p.m. Eastern Time, but by 8:50 p.m. it had climbed back above $60,000. The initial drop reflected heavy selling pressure, but the later rebound—though slow—suggests a potential recovery might be on the horizon.

Bitcoin Reclaims $60K After Market Dips: Traders Face $191M in Losses

During the sell-off, bitcoin’s (BTC) trading volume spiked, then gradually declined as the price began to recover, hinting at either reduced market activity or cautious buying. The latest one-hour chart shows mostly neutral signals.

The one-hour chart shows the relative strength index (RSI) sits at 45, Stochastic at 57, and the awesome oscillator displays slight negative momentum. Yet, indicators like momentum and the moving average convergence divergence (MACD) hint at a bullish trend, with values of -251 and -318, implying some upward movement despite market uncertainty.

Coinglass data reveals that $191.13 million in liquidations across the crypto market were settled on Oct. 10, with around 57,743 traders losing positions. Out of the total liquidations, $148.22 million came from long positions, and $53.82 million of those were tied to bitcoin (BTC) derivatives.

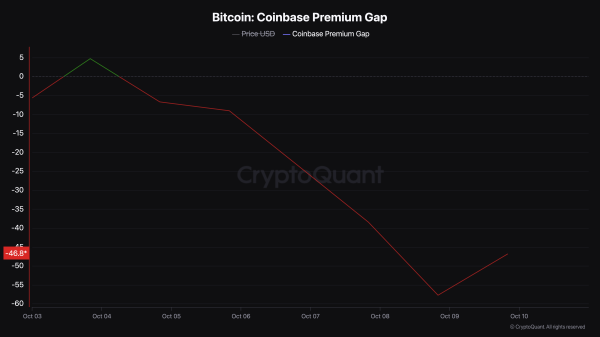

One unfortunate trader on Binance lost $10.51 million in a BTC/USDT position, marking the largest single liquidation on Thursday. By 8:50 p.m., South Korea’s bitcoin premium stood at 1.23%, a promising sign considering it dropped to a discount on Oct. 5. Metrics from cryptoquant.com show Coinbase’s Premium Gap at a negative $46.86, typically indicating higher selling pressure from U.S. traders.

On Thursday, BTC’s market value was $1.19 trillion out of the $2.11 trillion total crypto market, giving bitcoin over 56% dominance, while the crypto fear and greed index pointed to a “fear” score of 37. As bitcoin navigates volatility, the balance between cautious optimism and market uncertainty remains delicate.

Traders appear more hesitant, reflecting broader concerns about sustainability in price recovery. After 9 p.m. on Oct. 10, BTC was struggling to hold the $60,000 range.