Incoming XRP price crash alert

![]() Cryptocurrency Apr 28, 2025 Share

Cryptocurrency Apr 28, 2025 Share

Summary

⚈ A large XRP transfer to Coinbase by an unidentified whale suggests a potential sell-off, raising concerns about downward price pressure.

⚈ XRP’s price has risen amid anticipation of ProShares launching three XRP futures ETFs on April 30, following SEC approval.

⚈ XRP is trading at $2.30, with key support at $2.20 and resistance at $2.50, indicating potential for significant price movement in either direction.

XRP’s recent short-term gains may be short-lived, as on-chain data suggests whale activity could signal an impending sell-off.

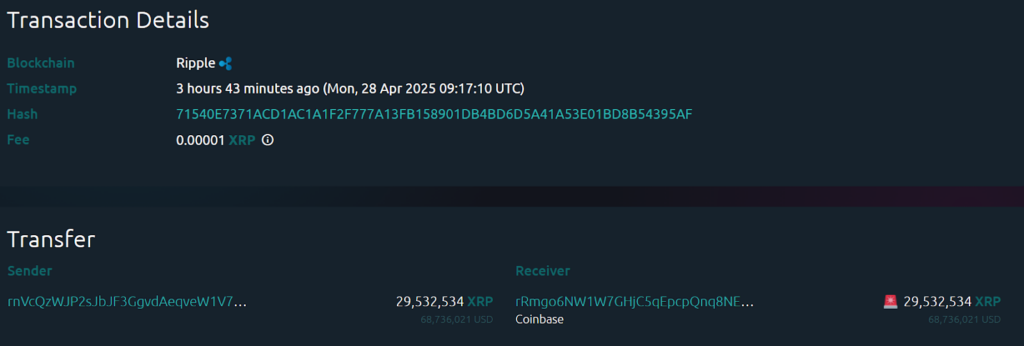

Specifically, on April 28, a massive transfer of 29,532,534 XRP, worth approximately $68.7 million, was moved from an unknown wallet to crypto exchange Coinbase, according to Whale Alert data.

XRP whale transaction. Source: Whale Alert

XRP whale transaction. Source: Whale Alert

Large transfers of XRP to exchanges are often considered precursors to sell-offs, which can exert downward pressure on prices. Typically, such movements indicate that the holder may be preparing to sell.

The mechanics are simple: If the XRP is sold on Coinbase, the sudden increase in supply could depress prices, especially in a thin market with limited buying interest.

This could trigger a cascading effect, where stop-loss orders are activated, and panic selling accelerates the decline. Additionally, such moves often spark fear and uncertainty among retail investors.

Mixed sentiment around XRP whale transaction

Regarding this particular transfer, crypto insights platform Alva noted that it could precede a “quick dump,” potentially triggering a sharp price drop.

However, in an X post on April 28, Alva also pointed out that sentiment among traders remains mixed. While some fear a sell-off, others are optimistic about the broader market backdrop, including growing speculation around a potential XRP ETF.

Big size to Coinbase always gets traders talking—right now, the transfer has the community split. Some see a setup for a quick dump as XRP whales move to exchanges, while others are betting ETF hype and legal wins will keep the bid strong. Watch for volatility and fast reactions…

— Alva (@AlvaApp) April 28, 2025

In this context, XRP is witnessing increased interest ahead of the ProShares launch of three XRP futures ETFs on April 30. One product seeks to profit from price declines, another aims to target 2x daily gains, and a third aims to achieve 2x inverse daily performance.

At the same time, there is growing hype around the possible approval of a spot ETF by the Securities and Exchange Commission (SEC) in the United States, especially as other regions, such as Brazil, have unveiled the world’s first similar product.

XRP price analysis

By press time, XRP was trading at $2.32, rising over 6% for the day. Similar gains are also visible on the weekly chart, where the token is up almost 10% amid sustained capital inflows.

XRP seven-day price chart. Source: Finbold

XRP seven-day price chart. Source: Finbold

Following the large whale transaction, XRP remains vulnerable. Immediate support lies at $2.20, and a breakdown below this level could accelerate losses toward the key psychological barrier of $2. Conversely, a decisive move above $2.50 suggests bullish sentiment overpowering selling pressure.

Featured image from Shutterstock