Trading expert sets Bitcoin price for the weekend; Should you follow suit?

![]() Cryptocurrency Nov 8, 2024 Share

Cryptocurrency Nov 8, 2024 Share

Bitcoin (BTC) broke out of its all-time high on November 6, currently consolidating above that level before its next move. In the meantime, a cryptocurrency trading expert has set his BTC price targets for the weekend, aiming at higher levels.

The trader is CrypNuevo an Spanish analyst who has showed high accuracy and good win rate with his trades and signals. Finbold has covered plenty of CrypNuevo’s analyses, which help retail traders and investors to navigate Bitcoin’s volatile price action.

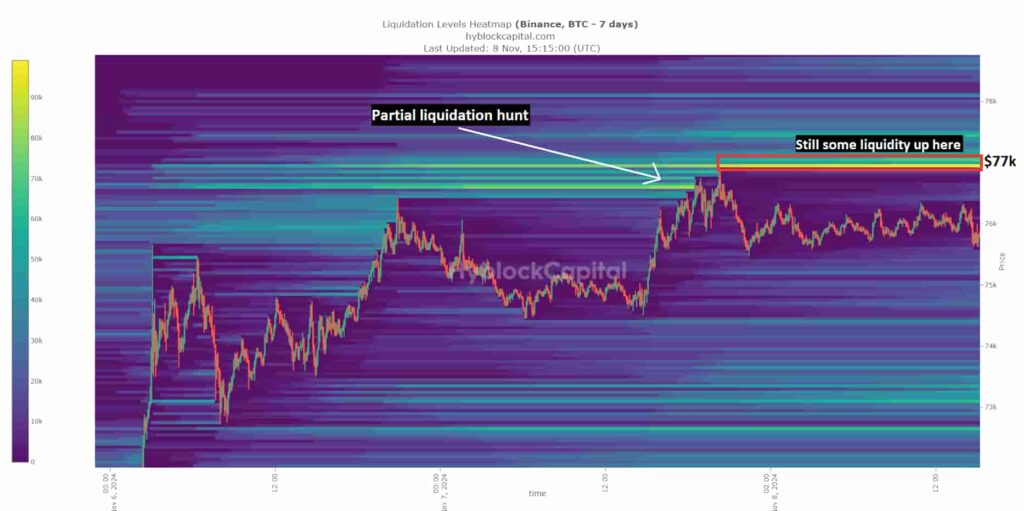

In particular, CrypNuevo’s believes Bitcoin could short-squeeze to $77,000 and $77,500 at one point during the weekend. This is due to accumulated liquidations from short positions between these levels, making a magnet for BTC price.

Picks for you

Analyst sets XRP price roadmap to $5.85 24 mins ago Why the cryptocurrency market is the ‘biggest winner’ of U.S. elections 55 mins ago Here’s what happened to Ripple’s prepared ‘largest XRP dump’ in 7 years 3 hours ago Should investors be worried about a Great Depression 2.0? 4 hours ago

“Yesterday, during FOMC, we saw a partial absorption of the liquidations to the upside. And considering that there is now even more liquidity between $77k-$77.5k due to the sideways move over the past 16 hours… it’s highly possible that we see a new spike up to that zone.”

– CrypNuevo

Bitcoin (BTC) liquidation levels heatmap, seven-day time frame. Source: HyblockCapital / CrypNuevo

Bitcoin (BTC) liquidation levels heatmap, seven-day time frame. Source: HyblockCapital / CrypNuevo

Bitcoin price analysis

Interestingly, reaching the trader’s targets for the weekend would drive Bitcoin to new all-time highs, continuing its price discovery. It would also mean 19.5% gains from current prices of $76,013.

The leading cryptocurrency peaked at $76,884 after clearing the liquidity pools following Donald Trump’s victory and the The Federal Open Market Committee (FOMC) meeting, breaking out of the $73,800 resistance reached in March, this year.

What was previously resistance may now have become a key price support, which is yet to be tested. Thus, before reaching the $77,000 to $77,500 price target, Bitcoin could retrace there, creating an impulsive baseline.

On the other hand, the correction could also come after reaching these targets and clearing the upward liquidity. BTC’s momentum on the daily chart is remarkably strong with a relative strength index (RSI) of 70.96.

Bitcoin (BTC) daily price chart. Source: TradingView / Finbold / Vinicius Barbosa

Bitcoin (BTC) daily price chart. Source: TradingView / Finbold / Vinicius Barbosa

Bitcoin mid-term strategy: Time to buy or sell BTC?

Meanwhile, Ki Young Ju, founder and CEO of CryptoQuant, is warning investors of Bitcoin’s growth limitations. According to the executive and onchain analyst, BTC would like go up 30% to 40% from current prices, but hardly much higher than that as many newcomers might want to believe.

Ki Young Ju believes we are entering a phase in the market where Bitcoin investors should be planning how and when to exit from their positions, instead on going “all-in” like the fear of missing out (FOMO) could lead them to think.

New investors often hold $BTC through bear markets, enduring losses.

After about two years, it changes hands when pain eases. That time is now.

It could go up +30-40% from here, but not like the +368% we saw from $16K. Time to consider gradual selling, not all-in buying, imo. pic.twitter.com/hXRT6YBsxS

— Ki Young Ju (@ki_young_ju) November 6, 2024

This stance aligns with many other analysts who have been positioning to an expected altseason, including CrypNuevo, as previously reported. Some solid altcoins could offer 30x-return opportunities, according to cryptocurrency traders, absorbing Bitcoin’s liquidity in an incoming altcoin bull rally.

While experienced traders and investors set their strategies and price targets, readers should remain cautious and understand that even experts can be wrong and lose money. Creating a solid plan with proper risk management and knowledge is crucial to navigate the market.