Why Bitcoin’s guarantee of $135,000 target could emerge this week

![]() Cryptocurrency May 20, 2025 Share

Cryptocurrency May 20, 2025 Share

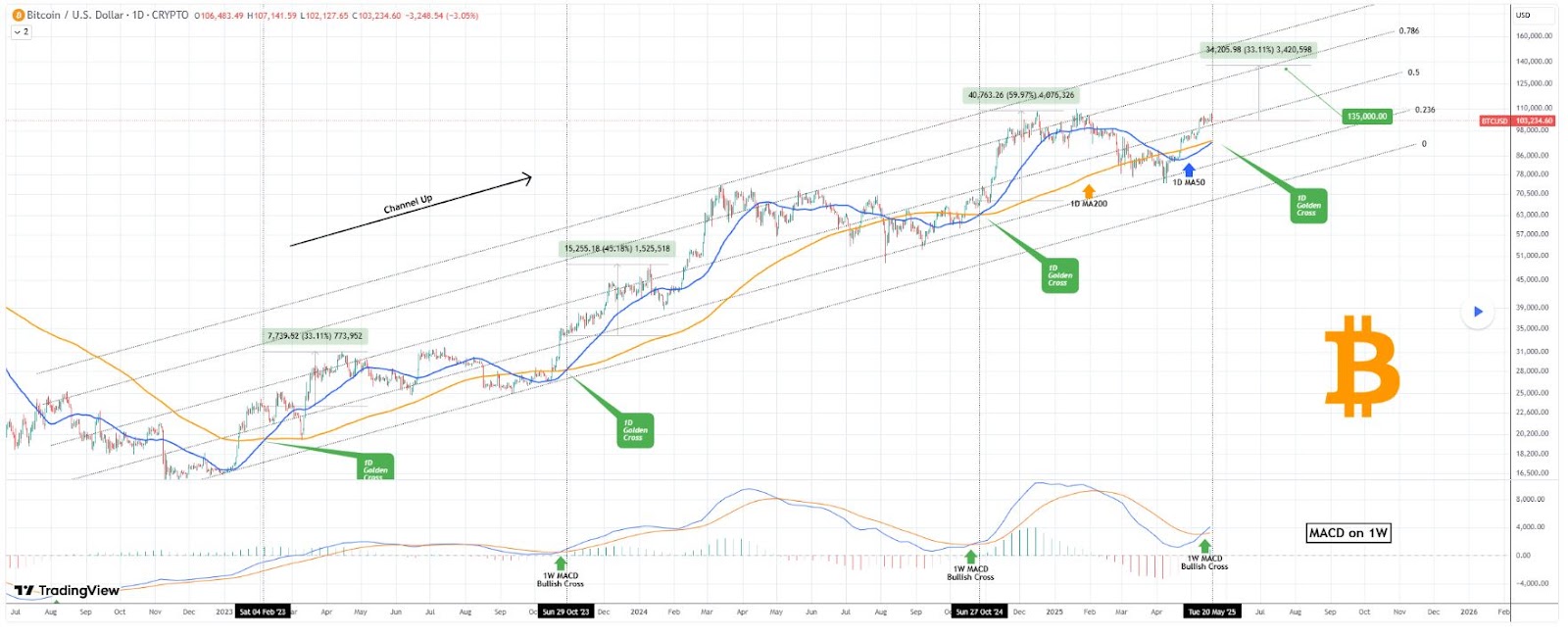

Bitcoin (BTC) may be on the verge of a major technical breakout that could come as early as this week, potentially targeting a record high of $135,000.

In this line, analysis by TradingShot indicated that the asset is set to form its first one-day golden cross in seven months, the last occurring on October 27, 2024, which could trigger an immediate surge, the analyst noted in a TradingView post on May 20.

This bullish signal, where the 50-day moving average (MA) crosses above the 200-day MA, has historically preceded strong rallies.

Bitcoin price analysis chart. Source: TradingView

Bitcoin price analysis chart. Source: TradingView

Bitcoin’s next price target

Notably, every one-day golden cross within Bitcoin’s two-and-a-half-year ascending channel has sparked a rapid price increase, with the smallest gain at 33.11%. The analyst projected a move to roughly $135,000 from the current price, aligning with the 0.236 Fibonacci level.

Further strengthening the case, the one-week Moving Average Convergence Divergence (MACD) has already flashed a bullish cross, a signal that preceded the last three golden crosses. These indicators suggest a breakout above Bitcoin’s previous all-time high of $109,000 may be imminent.

After bouncing back strongly from the trade tension correction, Bitcoin is regaining momentum within its rising channel.

Adding to the optimism, crypto analyst MikybullCrypto noted in a May 20 X post that, if confirmed, the golden cross could propel Bitcoin toward $145,000 based on historical patterns.

GOLDEN CROSS IMMINENT ON $BTC

A HUGE RALLY INCOMING

LOOK AT THE PREVIOUS CROSS 😎 https://t.co/luHNauLQ7w pic.twitter.com/xq0gIEa7nL

— Mikybull 🐂Crypto (@MikybullCrypto) May 20, 2025

Currently, Bitcoin is challenging a new all-time high above $110,000 amid renewed investor interest and buying pressure. It has also claimed the sixth-largest asset by market cap position, surpassing Alphabet (NASDAQ: GOOGL).

Meanwhile, capital inflows into Bitcoin exchange-traded funds (ETFs) are accelerating. On May 19, U.S. spot Bitcoin ETFs recorded $667.4 million in net inflows, the highest since May 2, driven by $306 million into the iShares Bitcoin Trust.

Bitcoin price analysis

Bitcoin was trading at $105,275 by press time, up 2.2% over the past 24 hours and 2.6% on the week.

Bitcoin seven-day price chart. Source: Finbold

Bitcoin seven-day price chart. Source: Finbold

While sentiment remains bullish, Bitcoin’s momentum could face short-term resistance. The 14-day relative strength index (RSI) is 68, approaching overbought territory.

Still, Bitcoin remains firmly above key technical levels. For instance, the 50-day ($92,255) and 200-day ($86,257) simple moving averages sit well below the current price, reinforcing its strong upward trend.

Featured image via Shutterstock