XRP network activity crashes 44%; Is $1 drop next?

![]() Cryptocurrency Apr 20, 2025 Share

Cryptocurrency Apr 20, 2025 Share

The XRP network is seeing a drop in new addresses, which could pressure the asset and threaten its hold above the key $2 support.

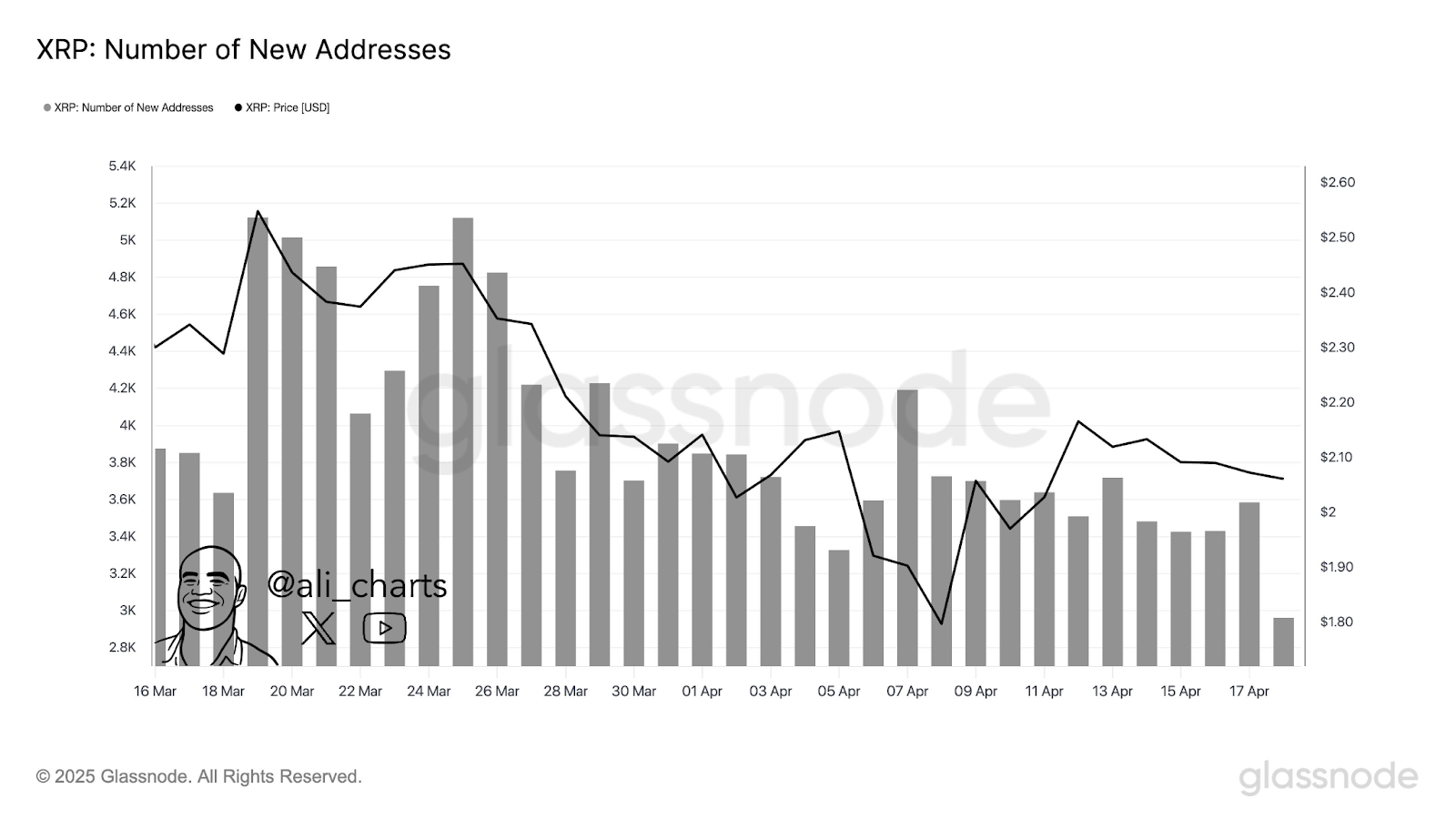

Specifically, the number of newly created addresses has dropped by 44% over the past month, falling from a high of 5,200 on March 22 to just 2,900 by April 17, according to data from cryptocurrency analytics platform Glassnode.

Number of new XRP addresses chart. Source: Glassnode

Number of new XRP addresses chart. Source: Glassnode

This drop in network activity aligns with XRP’s price decline, as fewer new addresses, a key sign of adoption, often signal weakening investor confidence and can precede further losses.

Notably, the declining new addresses comes at a time when XRP’s technical setup is painting a bearish picture amid ongoing price consolidation.

XRP bearish technicals

To this end, in an April 17 analysis, cryptocurrency trading expert Ali Martinez observed that XRP is exhibiting a textbook bearish head-and-shoulders pattern.

The formation shows a clear left shoulder, head, and right shoulder, with the price recently breaking below the neckline around $2.05. A retest of this level has already occurred, often a precursor to continued downward movement.

XRP price analysis chart. Source: TradingView/Ali_charts

XRP price analysis chart. Source: TradingView/Ali_charts

This pattern, commonly seen before market reversals, suggests XRP could be headed much lower. If confirmed, the move could drag prices down to the $1.30 and $1.40 range, representing a potential drop of over 30% from current levels.

Unless XRP can reclaim the neckline as support, the risk of a deeper sell-off remains high.

Meanwhile, as reported by Finbold, pseudonymous analyst CrediBULL noted that for XRP to stage a recovery, it needs to establish a bottom in the $1.60 zone. At the same time, short positions have surged, with bears eyeing levels below the $2 mark.

In addition to the bearish technical setup, XRP has also seen a spike in whale transactions. This comes as the asset potentially approaches a major regulatory milestone, with the legal battle between Ripple and the Securities and Exchange Commission (SEC) nearing a conclusion.

XRP price analysis

XRP extended its losses at the time of writing, trading at $2.04, down nearly 2% over the past 24 hours. Over the past seven days, the asset has corrected by more than 7%.

XRP seven-day price chart. Source: Finbold

XRP seven-day price chart. Source: Finbold

Sentiment around XRP remains bearish, supported by a Fear & Greed Index score of 37 (Fear). Technically, the price is trading below the 50-day simple moving average (SMA), indicating short-term downward momentum, though it remains above the 200-day SMA, suggesting long-term strength.

The asset’s 14-day Relative Strength Index (RSI) is 49.40, indicating a neutral stance, while volatility is moderate at 7.74%, suggesting relatively stable but cautious trading conditions.

Featured image via Shutterstock